Tips for Conquering Fraud Prevention & Identity Theft

Note: This post is sponsored by Capital One Canada, all thoughts and opinions are honest and my own.

Conquer Fraud Prevention & Identity Theft!

Dealing with fraud is never on the top of anyone’s bucket list. However, fraud happens to even the best of us, it’s how you deal with it that matters. Dealing with fraud before it happens is always your best bet. Fraud prevention is a real thing and Capital One Canada is a great resource for learning all about fraud prevention and how to protect yourself.

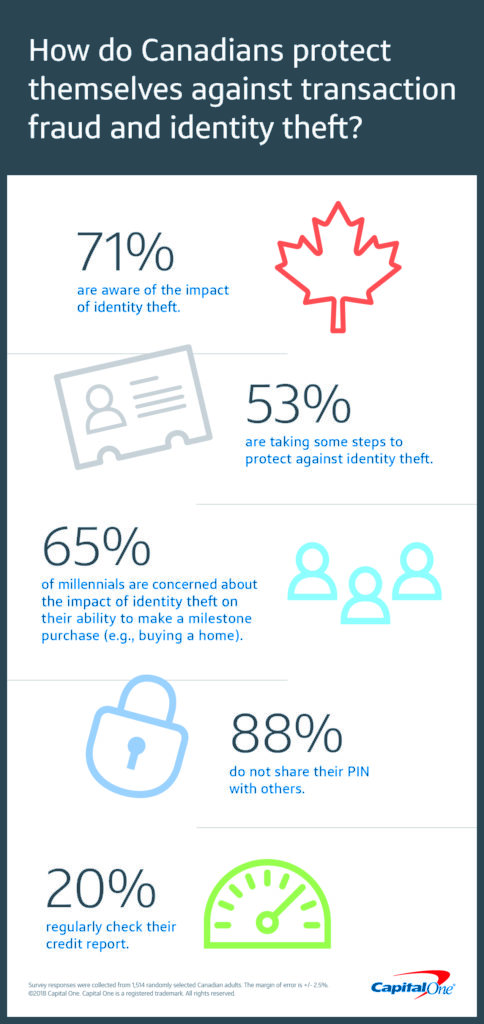

According to a study by Capital One, the majority of Canadians are aware of the impact identity theft can have on their personal finances, including their credit score (71%) but only half (about 53%) are taking some of the recommended steps to protect themselves from identity theft. This includes measures like managing your social media account security settings, which can put people at risk of fraud. There are lots of ways to take control and protect yourself, and most of these actions start at home.

Take Advantage of Fraud Prevention on Your Credit Card

Did you know that most credit cards offer some sort of opt-in fraud detection feature? These features include, two-way fraud alerts and purchase notifications so you know what is being purchased and can recognize whether or not you made the purchase. If you have access to these options, make sure to take advantage of them.

Monitor Your Credit Score

Staying on top of your financial activity is key. You should know if someone tries to open a new loan account in your name or worse, has used your information to default on a loan. Capital One was the first bank in Canada to offer free credit scores to cardholders via the Credit Keeper* platform. This tool indicates recent inquiries on your credit file, allowing you to vigilantly watch for unexpected activity.

Report a Lost or Stolen Card

When it comes down to it, you have to be vigilant about fraud. If you have lost your card, you will want to report it right away. If someone has stolen your card, you should report this right away. Reporting a lost or stolen card can help prevent fraud.

Get Informed

March is Fraud Prevention Month and a great time to look at your finances. You should take a minute to examine your accounts, your security settings and the steps you take to protect yourself from fraud to ensure your personal information is adequately protected.

Here are a few other things you can do if fraud happens to you!

- Always contact your credit card issuer for help.

- Check your credit report to ensure more fraud didn’t occur.

- If you are a victim of identity theft, have a fraud alert put on your credit profile.

- Finally, use Credit Keeper from Capital One, it’s free. It indicates recent inquiries on your credit file, allowing you to vigilantly watch for unexpected activity.

Also, make sure you visit the Capital One website at www.capitalone.ca/fraudprevention to see how you can avoid fraud and protect yourself from it. It is a great resource to learn more about credit too!

What do you do to make sure you don’t fall victim to fraud?

Let me know, til then–cheers m’deres!

*Credit Keeper is a service offered by Capital One Canada and is powered by credit history and score information provided by TransUnion. Availability may vary depending on the ability to verify your identity and obtain your information from TransUnion. The credit score provided by Credit Keeper is intended for your educational use only. Lenders and other commercial users may use a different type of credit score and other information when making credit decisions. Currently, Credit Keeper isn’t available for Capital One customers who live in the province of Quebec, or who have a Capital One Mastercard exclusively for Costco members.

PIN FOR LATER:

Nancy Polanco is a freelance journalist, lifestyle content creator, and editor of Whispered Inspirations. She is a proud Mom to Gabby and Michaela and partner and best friend to Darasak. Having worked as part of a health care team for almost a decade, Nancy is happy to be back to her passion. She is a contributor to the Huffington Post, TODAY’s Parents, and an Oprah Magazine Brand Ambassador.

I stay on top of our cards and bank account, having multiple alerts set to me, if something looks askew. It’s so important to protect your identity because people are always lurking.

They are always looking for an in.

Fraud prevention is a really big problem. Learn much and will take some of these and change what we do.

Awesome!

We monitor our score and we have signed up for alerts. There are so many ways people can get your info now it never hurts to be cautious.

Yes, I have set up alerts too. So helpful.

These are all great tips! It’s so easy these days for your information to be stolen. I’m glad you wrote this because there could be someone out there currently going through this and are very confused and upset.

Thank you, I hope we can all talk about this more and learn to be more vigilant.

So many important things to consider! I think it’s really important to do as much as we can to protect our identity. These are great tips!

Thanks, just being a little proactive can go a long way!

This is such a useful service they are offering, with fraud becoming more and more common. It’s impirtant everyone monitor their credit, even people that don’t use credit cards.

It is incredibly important, I am glad they offer it too. Makes it easy.

These are such great tips. I’ve had my info stolen way too many times. It’s so awful to know that there are people out there that do these things.

It is sad, that is for sure.

These are great tips, we always monitor our credit score via free monitoring offered by two different companies.

Awesome, it is great to keep on top of.

Thank you for sharing these great tips! I agree it could happen to anyone!

My pleasure!

These are really good tips to prevent fraud. Everyone needs to be so careful today. Thanks for sharing.

My pleasure, you are right! We should be very careful.

This is one thing that I really am very vigilant in tracking. I do my best to avoid identity theft. That’s scary if you fall victim to that kind of fraudulent activity. Thanks for sharing your tips. It is a must that we regularly monitor our credit cards and bank statements for unauthorized purchases.

It really can be scary! We have had close calls.

You are saving someone some serious trouble. I think everyone needs to see this post.

Thank you Sara, I really hope it can help someone.

I have had some scares when it comes to this topic. This is definitely something to take seriously.

Definitely, it can happen to anyone.

This is such a scary topic! I am terrified of having my identity stolen! It is so easy these days! Thank goodness for sites like Capitol one sites that provide valid information for scared people like me.

Seriously! I am glad they are so vigilant.

It sounds like Capital One Canada is trying to stay one step ahead of fraud with its fraud prevention platform – Credit Keeper. We recently had a friend whose identity was hacked. It is so scary. I’m going to have him look into this.

Awesome, hope it can help him.

Great tips! I picked a bank that is on top of their game. They are not afraid to call me in a middle of a transaction to see if it really me buying whatever. I love that!

Wow, that is awesome!

Protecting yourself from fraud and identity theft is sooo important!! It is so easy for anyone to get your info these days!! Great info!!

Thanks, hope it helps!

The Internet has opened a ton of opportunities for hackers to steal yoir personal information. We have had our credit card compromised and someone racked up a few charges. My husband cauht it quickly and called the retaiker to tell them the order was fake. After the first charge, later in the day they went on a shopping spree. Thankfully, we were able to get a new debit card and the situation wasn’t worse. Dealing with identity theft has to be super stressful.

Wow, now that is nuts. I am glad you guys caught it and hope you got it straightened out.

I’m bookmarking this for future reference. Identity theft has become such a huge issue, and the thieves are getting more and more savvy about it every day.

Yes, they definitely are. We have to remain vigilant.

I am very much on top of my credit score because I am OCD about it LOL. These are all great tips and I follow all them! People NEED to stay on top of their credit or someone will steal it.

Thank you so much. You are right, it is so important.

This is so important. Thanks for the tips, I have been through this more times than I can count at this point. I hate it!

Oh no, that is not good. Hope you have better luck.

These are great tips and a serious topic. We all need to be careful of fraud and identity theft. Thanks for sharing!

My pleasure, and you are absolutely right.

Theses tips are awesome! Identity theft is too common and has grave consequences so preventing it is so critical!

Yes, it is so important.

These are some great ideas. I’ve been a victim and it is horrible. We all need to implement these things to help combat the problem

I am sorry you fell victim to this.

I already have Credit Keeper from Capital One. I do check it regularly. It is a great service.

Sweeet! It definitely is a great service.

My credit card company is quite good at fraud prevention. They alerted me earlier this year about a charge in New York that I did not make.

That is great!

Fraud and identity theft are 2 of the scariest thing that could ruin once life. I had an experience when my sister-in-law was stolen all her cards were used. There have been unauthorized transactions that we have to report to the banks and we have called 2 most go to fraud company to freeze all her accounts especially bank accounts.

Wow, that is scary!

We always make sure to check our credit score regularly and check our statements and bank account every single day. Hubby has been a victim of fraud before so we always try to stay on top of it. Great tips!

It is great to be proactive!

Thank you for sharing this. I am getting ready to travel and do not need to deal with this!

OMG, yes, especially then.

Thanks for the great tips. My brother just found out someone stole his identity and it freaked us all out. It’s scary and frustrating that this happens.

Oh no, that is so scary.

Identify theft is now joke. I am so glad you showed me this.

It really is not! It is my pleasure. 🙂

Thank you for the tips. As much as I do not want to think about it, there are just some sneaky people out here and it is necessary to take advantage of fraud protection. I need to pull my report as well jus to be sure.

Yes, you have to be very careful and vigilant.

I try to monitor my credit card and score. I think these things can really help me stay on top of things!

Yes, these are definitely ways to stay on top of it.

Great tips! It’s crazy just how much fraud there is these days, I think it’s with having the internet for sure. My card details have been cloned four times now!

Oh my goodness! I hope it does not happen again.

Great tips to prevent fraud. There is so much out there, these tips are good to know. Thanks you

My pleasure, I hope they help.

When I was younger and I had a ton of credit card debt I didn’t think too much about this because who in the world would want my identity? Not the healthiest or smartest way to think, I know. But now that I’ve paid it off I am always so careful. Thanks for the tips.

My pleasure!

This always makes me nervous. It amazes me how gusty thieves are. These are great tips, hopefully I never need to use them!

They are great for preventing them, I hope you use them!

I have an app on my phone that monitors my credit daily. I am obsessed with checking it!

It is a great thing to keep an eye on it.

It is a great idea to get fraud protection. I’ve heard it is a really long and tedious ordeal to get your records cleaned out if they are hacked! Being protected would save a ton of time, money, and heartache! Thanks for the info!

Yes, you are so right.

These are absolutely valuable tips for protecting credit!!! I’m definitely sharing this post and saving it for reference….

Thank you for sharing Daisy.

This sounds like a great service. I had my identity stolen years ago and it was a horrific experience. Being an online influencer truly opens my personal book to share so much about myself, also adding to the risk of identity theft. Protecting yourself is so important but even more so, feeling confident with your information is the most important piece after being a victim of identity theft.

This is so true. I completely agree.

These are some great, but easy tips for people. I honestly don’t think I have checked my score in a while so I will put that on my to do list for this week. Thanks for sharing.

My pleasure, it is always good to stay on top of it.

These are all fantastic points to consider. Thank you so much for the info

My pleasure!

These are such great tips. My credit card number was recently stolen and thank goodness my credit card company called to let me know. They wound up charging 1000’s!

WOW, that is so crazy and happens more often than we think.

what a useful article! i know someone whose identity was stolen and suspects it has got to do something online! as much as i embrace technology, it is also very important to be careful, sadly!

Yes, it is always best to be very careful.

We are already having to help our young adult daughter with this. These are wonderful tips for this dreadful occasion.

Oh no, I am so sorry that you are going through this.

These are such great tips! It’s important to be prepared in the event that this does happen.

Thanks, I do hope they help.

My sister is really good about staying on top of this and I am not. I like the idea of using the built in credit card protection. It’s easy but effective.

Yes, it really is!

You offer some great tips. This is something that we need to stay on top of. I know someone that this happened to and she was treated like the criminal when she was trying to correct it.

]

Wow, that is not cool. I hope she settled it.

As someone who has had identity theft three different times, this is definitely an excellent post! Sharing so more people can become aware!

Thanks for sharing and I am so sorry that this happened to you three times.

Fraud is something that definitely scares me. I have a great bank though and they will block a card even if we are shopping out of an ordinary area and spend a large amount.

That is great!

These are definitely some great tips in dealing with fraud. It is all too real to have a breach happen to you.

So very, very true.

I know I can do more to protect myself. It’s scary to think how much trouble it can be when your identity or credit is stolen. You save yourself a lot of drama staying on top of it.

It can be very frustrating!

My husband is the one in charge of these things and I do my part my trying to protect our bank information and sensitive personal information from fraud. These fraudsters have been really innovative in trying to steal your information. I had a close call when I received an email with the subject line, “Fraudulent activity in your bank account detected.” But when I checked on the sender’s email address, it was a personal email account. Ack. It is really important to be careful with emails too. Sometimes a few get past the spam filter.

Yes, emails can be tricky and they are meant to scare you so you enter your personal information.

Identity fraud is one of the things I worry most about, these are good tips for protecting yourself.

Thanks, I hope they help!

I am always tracking my bank account and get alerts when something doesn’t look right or sounds like it’s wasn’t me.

Us too, we get text notifications from Capital One.

I appreciate this post! I know it can help so many people from a serious issue. This was good, thanks for sharing!

My pleasure!

We put fraud alerts on our accounts every 3 months which is free. Love this post!

We do too, we get a notification from Capital One whenever the card is used.

This is such an important post! I have had in the dreadful experience of having my identity stolen. I had to put a block on my credit report and have had to get new credit cards multiple times because of this. Knowing how to protect your identity is so important in the digital age.

I have had a bad experience too and it is crazy!

This is a really important post, for everyone to read – so if your parents or grand parents don’t have net access, make sure you print it off and show them, because they need to be aware of all the dangers and scams! x

Such great advice! It is a great way to keep them informed.

I think we all have been victim to this. Thanks for the tips for prevention because this can be really frustrating!

It can definitely be so frustrating!