RateSupermarket.ca: It’s Financial Literacy Month– How Knowledgeable Are You & How Does Your Credit Card Rank? #MoneyWiseMoms

It’s Financial Literacy Month.

Financial Literacy is something that I think is very important. It’s something that if you don’t know enough about can lead to years of struggle. I’ll be honest, growing up; I didn’t know much about saving money or making wise financial decisions.

I made the mistake to get two credit cards when I was 18 and though I promised I would only spend what I made, soon enough, I had maxed them both out. It was only until I put my batteries on and worked hard to pay them off completely. That is when I truly learned the real value of a dollar and the importance of planning to be successful in your personal finances.

In fact, it’s something that I have gotten a lot better at but am always learning more about. Once I became a Mom, it gave me that extra push to want to know more! I don’t want my kids to run into financial problems and I can only help them if I teach them young.

How Does Your Credit Card Fare?

One thing is for certain, you can’t go at it alone. Luckily, there is RateSupermarket.ca to help you become savvier and more financially fit to manage your personal finances. With their comparison services, you’ll be on your way in no time.

In my adulthood, I’ve learned a lot more about credit cards and since we travel often, we wanted to see if we can have a credit card that would reward us.

You get to thinking, what offers the best value: a mile, a point, or cash back? Are annual fees worth it? How can a promotional interest rate help pay off a lingering balance?

I know I am not alone with these thoughts, these are some of the most common questions posed by Canadian credit card shoppers – but when it comes to choosing a card, it’s not always clear which are top performers.

RateSupermarket.ca, Canada’s comprehensive financial rates comparison site, has taken the guesswork out of picking your plastic with the 2015 Best of Finance Awards, a ranking of the hardest-working credit cards and banking products in Canada. Consumers can use RateSupermarket.ca’s Credit Card Rewards Calculator to help them choose and apply for THE perfect card for them.

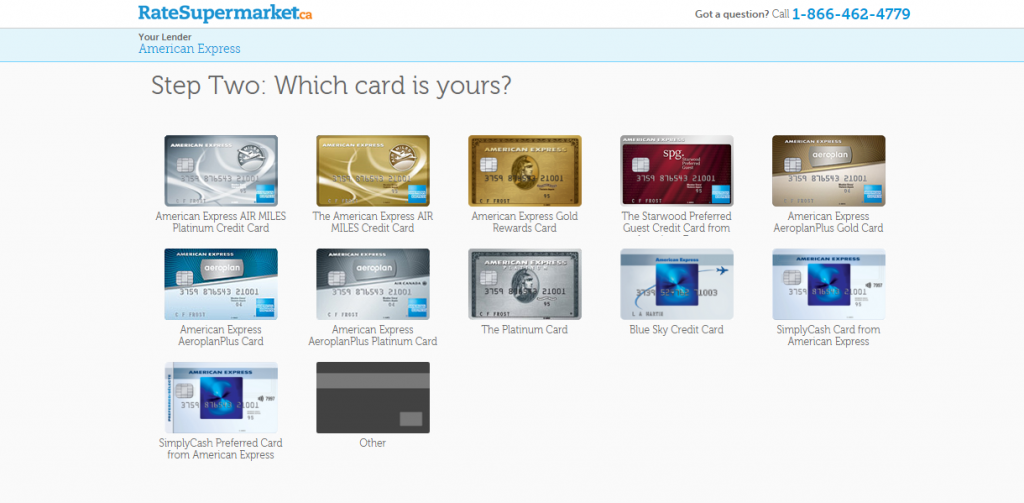

How Did My Plastic Rank?

Well, after I added all the required information and my carrier, it turns out that I have the best credit card for the rewards that I want to collect. In fact, it’s an award winner. When we chose our card, we wanted the best card that would give us travel rewards. It also had a sign-up bonus and a lot of travel perks that would make our adventures easier and much more rewarding.

Finding the credit card that suits your needs best is kind of like finding THE one. After all, it is a long-term relationship that needs to be give and take.

The Best of Finance Awards have spoken and here are the results:

Cash Back

WINNER: Scotia Momentum® VISA Infinite* Card

2nd Place: MBNA Smart Cash MasterCard® Credit Card

3rd Place: SimplyCash Card from American Express

Travel Rewards – With Fee

WINNER: Scotiabank®* Gold American Express® Card

2nd Place: BMO® World Elite™ MasterCard®*

3rd Place: RBC Royal Bank® Visa Infinite‡ Avion®

Travel Rewards – No Fee

WINNER: Blue Sky Credit Card

2nd Place: Capital One® Aspire Travel™ Platinum MasterCard®

3rd Place: Shell AIR MILES®† MasterCard®* from BMO

Travel Rewards Loyalty Program

WINNER: TD® Aeroplan® Visa Infinite* Card

Grocery Rewards

WINNER: President’s Choice Financial® MasterCard®

Gas Rewards

WINNER: MBNA Smart Cash MasterCard® Credit Card

2nd Place: Shell AIR MILES®† MasterCard®* from BMO

3rd Place: Shell CashBack MasterCard®* from BMO

Low Interest

WINNER: MBNA TrueLine® MasterCard Credit Card

2nd Place: National Bank Syncro MasterCard®

3rd Place: Desjardins Visa Gold Modulo

Low Balance Transfer

WINNER: Platinum Plus® MasterCard® credit card

2nd Place: President’s Choice Financial® MasterCard®

3rd Place: Scotiabank Value® VISA* card

Building Credit

WINNER: National Bank MC1 MasterCard®

2nd Place: Home Trust Secured Visa Card

3rd Place: Capital One® Guaranteed MasterCard® (both secured and unsecured)

Student

WINNER: TIE – Scotiabank L’earn® VISA* card

WINNER: TIE – StudentAwards MBNA Rewards MasterCard® credit card

2nd Place: BMO® SPC®‡ CashBack MasterCard®*

Special Mention: Scotiabank SCENE® VISA* card

Be Savvy!

Over 7 million people have used RateSupermarket.ca to compare their personal finance products and have saved. If the average Canadian switched their credit cards, they can save up to $400 a year! We ran our numbers and compared our mortgage and it turns out we have a great rate as well. It’s great to know that there is a service you can count on to help you make wiser decisions or some assurance in knowing you’ve made the right ones!

You Can Save Too!

In just 3 easy steps, you can be on your way to savings too. RateSupermarket.ca compares credit cards, mortgages rates, chequing accounts and GIC rates. You enter your information and your goals and through comparison, you’ll be able to see through hidden fees and get the best rates available to you!

Like they say, the more you know.

So, how does your credit card fare?

Do you have the perfect one for you or will you be applying for THE one?

Let me know, til then–cheers m’deres!

Nancy Polanco is a freelance journalist, lifestyle content creator, and editor of Whispered Inspirations. She is a proud Mom to Gabby and Michaela and partner and best friend to Darasak. Having worked as part of a health care team for almost a decade, Nancy is happy to be back to her passion. She is a contributor to the Huffington Post, TODAY’s Parents, and an Oprah Magazine Brand Ambassador.

My husband is an accountant, so he takes care of all our budget stuff 🙂

Lucky!

My credit card does okay. I generally keep it out of the picture unless I need it for something big.

My recent post 7 Eco Friendly Ways we are Keeping Our Office Greener

That is good!

That is good!

We only have one credit card and it fares ok. I prefer to use a debit card or cash.

We just bough a house so we defiantly know our credit. We had a HUGE learning curve about 8 years ago and will never live with credit card debt again. Good reminder during this time of the year.

My recent post Easy Holiday Gift Ideas for Everyone on your List

Glad that you are on your way to living debt free!

It's so important to review your credit card info! I learned this the hard way and now I always try to stay on top of it.

Me too, it is so important!

Ratesupermarket.ca sounds like a great resource to keep bookmarked. It would be interesting to find out how my cards and rewards programs rank.

It is great to know so that you can get the best deal and rates.

I really enjoy RateSupermarket.ca I was so impressed by the credit card audit and to see where I could be saving more and what benefits I could get with other cards and how mine stack up!

It is great to know how they stack up for sure!

Ratesupermarket.ca offers an excellent service. People need to become more educated about their credit cards.

I agree, it is great to see how our plastic is rated.

This is such great information. We made the mistake of messing up our credit years ago and it took quite a long time to fix it. Thanks for sharing.

My pleasure, glad you are on your way.

I only recently got my first real credit card so I could build credit. Before the idea of a credit card terrified me, we were a cash or debit family. I could definitely use more education on this topic.

It is something that is necessary, glad you are getting more informed.

I had no idea that it was Financial Literacy month. I will have to check out that website!

My recent post Dress Up Your Turkey with Cranberry Apple Jalapeno Cilantro Relish

It is a great site to compare your financial services.

Oh cool! I have two of the top rated cards. That makes me happy.

Makes me happy too! It is good to know.

Financial literacy is so important, starting with teaching your kids while they're young so that they grow up with good money management skills. And I bet it's no surprise that Financial Literacy Month coincides with the biggest spending season of the year when many often go into debt by overbuying.

My recent post $100 Shutterfly Giftcard Giveaway Celebrates Love the Coopers Holiday Movie

Haha, you are very right. It is a great time to think about it!

I've made the same mistakes and I've really learned my lessons. Financial literacy is very important and you need to teach your kids about this, too, so they won't make the same mistakes you did.

Perfectly said!

I find these comparison charts so useful. RatesSupermarket sure will help me decide on what's best for me.

My recent post What do I do? Amwell Makes it Easy to Talk to a Doctor…First Visit Free!

So very useful!

Credit cards are a useful tool, but you have to be smart about how you use them!

You definitely have to be, it can have a big impact.